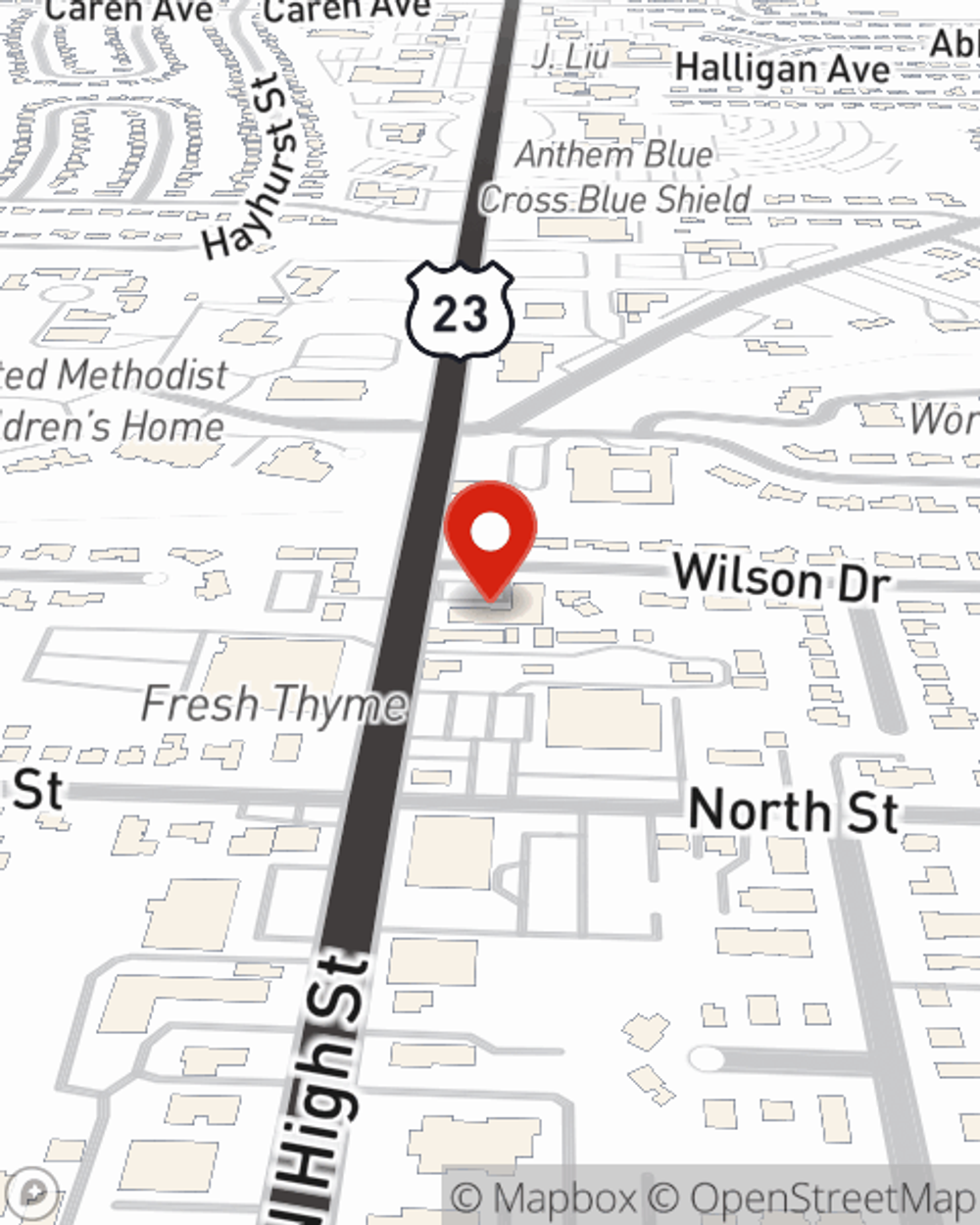

Homeowners Insurance in and around Worthington

Looking for homeowners insurance in Worthington?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- 43085

- 43235

- 43081

- 43082

- 43229

- 43224

- 43214

- 43016

- 43035

- 43231

Home Sweet Home Starts With State Farm

Home is where your heart is. You need homeowners coverage to keep it safe! You’ll get that with homeowners insurance from State Farm, the leading provider of homeowners insurance. State Farm Agent Mike Mathers is your understanding authority who can offer an insurance policy personalized for your unique needs.

Looking for homeowners insurance in Worthington?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Agent Mike Mathers, At Your Service

Mike Mathers will help you feel right at home by getting you set up with high-quality insurance that fits your needs. Home insurance from State Farm not only covers the structure of your home, but can also protect prized possessions like your family cookbook.

Whether you're prepared for it or not, the unanticipated can happen. But with State Farm, you're always prepared, so you can kick off your shoes knowing that your belongings are covered. Additionally, if you also insure your vehicle, you could bundle and save! Contact agent Mike Mathers today to go over your options.

Have More Questions About Homeowners Insurance?

Call Mike at (614) 846-7411 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Fire safety equipment to have at home

Fire safety equipment to have at home

Every residence should be prepared with home fire safety equipment to help in case of an emergency.

What to do after an earthquake

What to do after an earthquake

Steps to stay safe after an earthquake and ways to help protect your property.

Mike Mathers

State Farm® Insurance AgentSimple Insights®

Fire safety equipment to have at home

Fire safety equipment to have at home

Every residence should be prepared with home fire safety equipment to help in case of an emergency.

What to do after an earthquake

What to do after an earthquake

Steps to stay safe after an earthquake and ways to help protect your property.