Renters Insurance in and around Worthington

Looking for renters insurance in Worthington?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- 43085

- 43235

- 43081

- 43082

- 43229

- 43224

- 43214

- 43016

- 43035

- 43231

Calling All Worthington Renters!

It may feel like a lot to think through your sand volleyball league, family events, work, as well as savings options and deductibles for renters insurance. State Farm offers straightforward assistance and impressive coverage for your pictures, cameras and mementos in your rented home. When mishaps occur, State Farm can help.

Looking for renters insurance in Worthington?

Rent wisely with insurance from State Farm

State Farm Has Options For Your Renters Insurance Needs

Renters insurance may seem like not a big deal, and you're wondering if it's really necessary. But pause for a minute to think about how difficult it would be to replace all the stuff in your rented condo. State Farm's Renters insurance can help when unexpected mishaps damage your personal property.

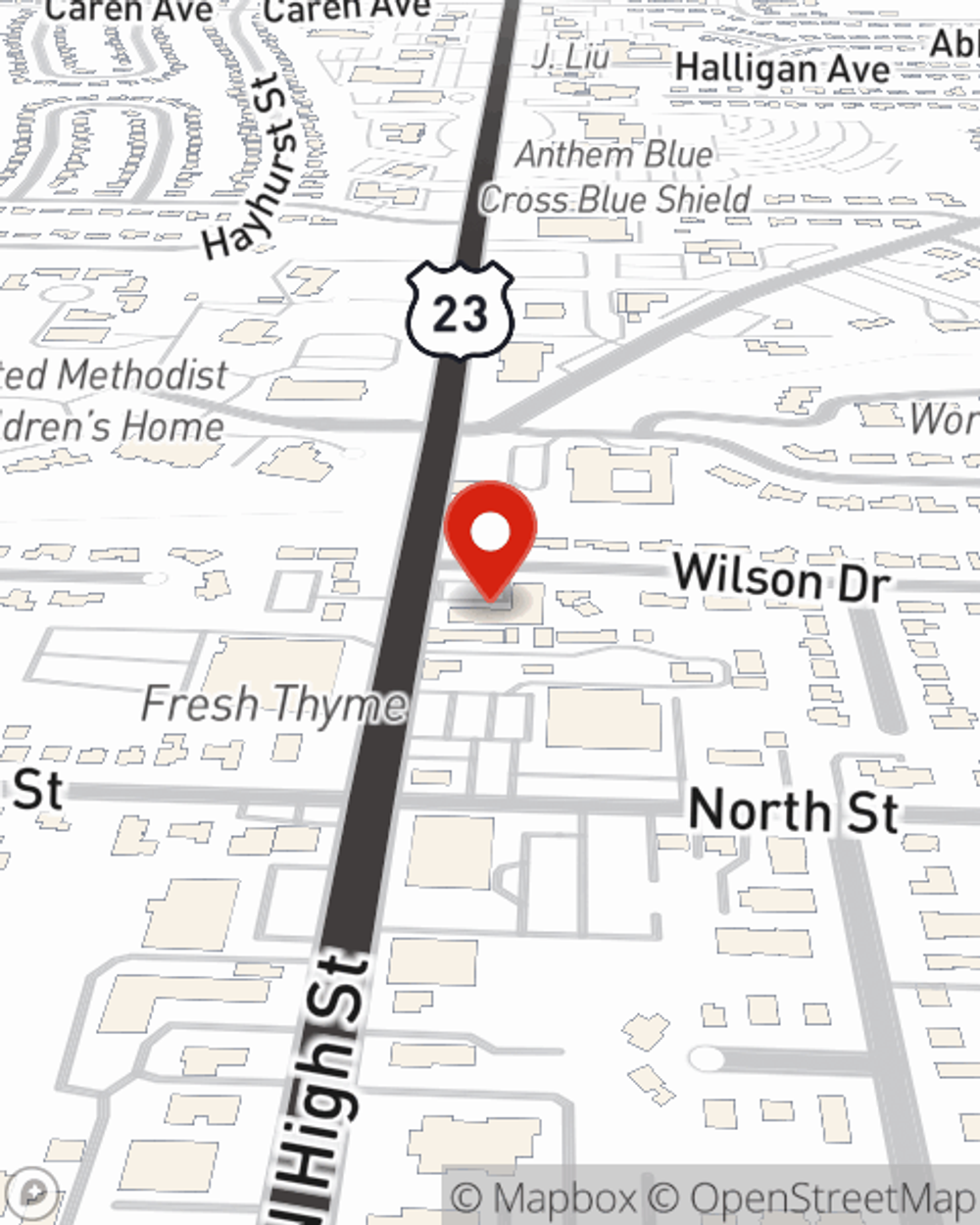

If you're looking for a value-driven provider that offers a free quote on a renters policy, get in touch with State Farm agent Mike Mathers today.

Have More Questions About Renters Insurance?

Call Mike at (614) 846-7411 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Mike Mathers

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.